The darling of the consumer goods market, the $646.20 billion global beauty and personal care market is expanding its scope and definitions. Be it products or segments, the health, beauty, and retail ecosystem is bubbling with constant transformations – wellness and beauty merging to form highly nuanced products for Gen Alpha, while adaptogens and dermal skincare are a Gen Z favourite.

While this definitely ripens the hot opportunity, it also complicates the already challenging demand forecasting and replenishment puzzle. Newly emerging segments, let alone products, leave retailers gasping for understanding demand, leading to manually-pivoted decisions based on negligible or no data-backing.

Result?

A chaotic inventory sob story, lost sales due to stockouts at some stores, and bloated inventory at others, choking the bottom line, inflating inventory costs, and stifling the operating capital like never before.

Here, we explore three core factors that cause inventory accuracy problems in health, beauty, and wellness retail and how retailers can fix them.

1. Nature of Inventory

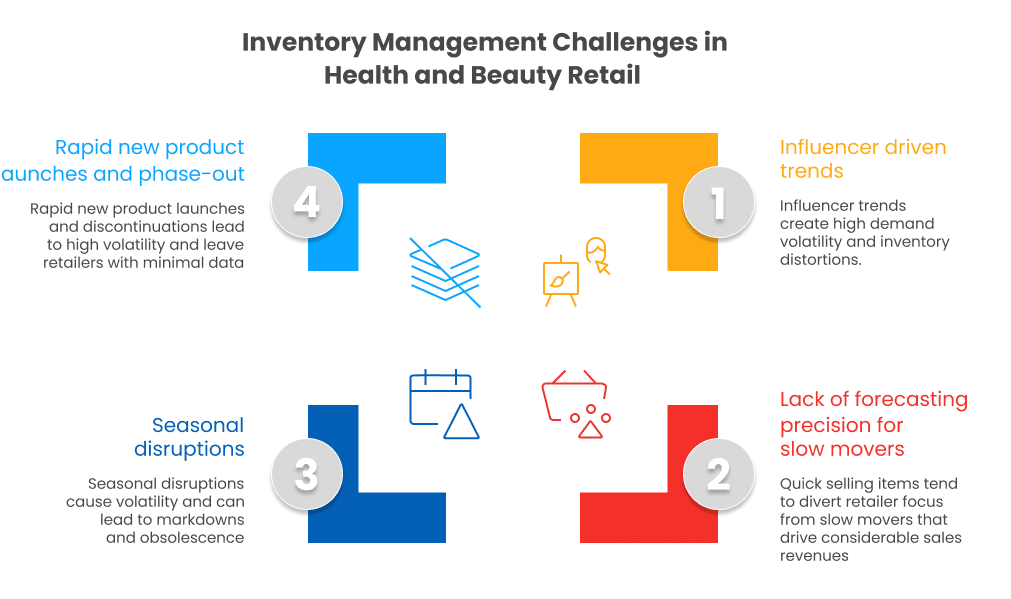

Unlike the traditional retail segments, like food and grocery, health, beauty, and wellness inventory mix is changing rapidly in multiple ways – new products are constantly flying off the shelves, and rapid product discontinuations are the norm.

Volatile product mix leaves little data footprint, making it absolutely impossible for retailers to model and forecast demand patterns with accuracy. This is mainly because traditional demand planning and retail inventory management solutions come with standard, one-size-fits-all approach that falters in the wake of data challenges like noise, gaps, etc.

Further, the majority of inventory is vulnerable to seasonal and trend-driven disruptions. Sometimes, a single video from a beauty or wellness influencer can render an entire category obsolete, while lifting demand in a dormant category. So, the demand and sales influencers become chaotic and extend beyond the computational abilities of static demand modeling.

2. Overlooked Revenue-Driving Categories

Traditionally, retailers have been focusing on the top 20% products that drive around 80% of the sales revenue, and overlooking the long-tail inventory, that consists of slow-movers. But, in health, beauty and wellness retail, these slow movers are driving as much as 40% of sales revenue.

This means that retailers can no longer afford to overlook their long tail inventory and need equal forecasting rigor forsuch products. However, traditional forecast modeling tools and inventory planning software dont offer such granular modeling and planning capabilities.

So, retailers are unable to tap into the extra revenue that they can drive from long-tail inventory.

3. Diverse Set of Promotions Running in Parallel

Another critical factor that breaks forecast accuracy are the complex in-store promotions that are running across multiple brands, products, and categories in parallel. In-store promotions are a great way to boost sales. However, they also trigger demand lifts and demand shifts across categories and within them.

While traditional demand forecasting solutions focus on demand lifts in the promoted products, they don’t factor in the demand shifts caused by promoted products in the non-promoted category/products. This leads to overstocking of non-promoted products, while the promoted ones go out-of-stock.

Both situations reduce the promotional gains, leaving retailers grappling with panic ordering and overstocked inventory. Further, the sales in health, beauty, and wellness retail are complex – bundled offers, BOGOs, seasonal offs, etc.

Mapping these demand shifts and lifts to prevent cannibalization is beyond the computational abilities of traditional tools.

How to Break the Vicious Cycle of Stockouts and Overstocks?

Solving the inventory replenishment puzzle requires demand sensing and planning beyond the category level. Since, the demand patterns are always evolving and the health, beauty, and wellness retail segment comes with its unique set of challenges, the solution lies in achieving hyperlocal accuracy with SKU-location-level demand modeling.

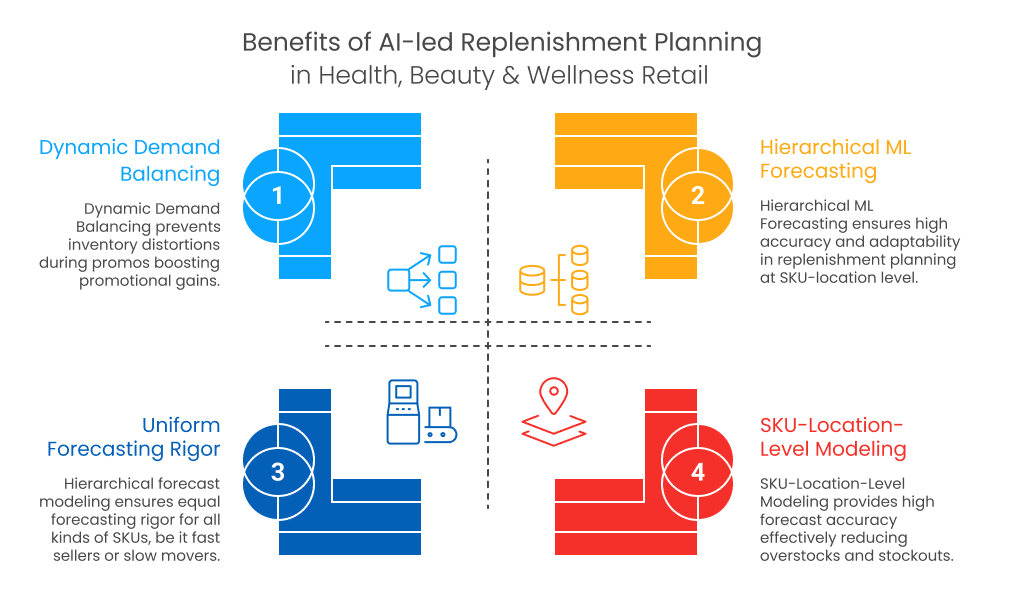

Hierarchical ML Forecasting for Rapidly Changing Inventory Mix

Demand forecasting and auto-replenishment frameworks built on hierarchical forecasting address the data challenges and learn from similar categories to model demand accurately. This empowers retailers to forecast demand accurately for each product location and ensure that optimal inventory levels are maintained at all times.

These solutions also come with the in-built functionalities that automatically tune replenishment recommendations as per the new product launches and discontinuations, making replenishment optimization an ongoing process without requiring manual intervention.

Hierarchical Forecasting for Uniform Forecasting Rigor Across All Types of SKUs

As retailers can no longer afford to overlook certain products and categories as they are driving a significant part of revenue, they need solutions that enable them to exercise uniform forecasting rigor for all kinds of products, including the long-tail.

Auto-replenishment solutions with hierarchical forecasting capabilities model demand for millions for the SKU-store location combinations for each SKU type, while factoring in complex and unlimited number of demand predictors. Thus, the replenishment recommendations generated by the solutions are extremely reliable, accurate, and prevent revenue erosion.

Dynamic Demand Balancing During In-Store Promotions

Another powerful benefit of demand forecasting and automated replenishment solutions is promotion-specific forecast modeling. It treats each bulk-buy offer as a distinct feature, capturing its unique cannibalization or growth effects on category demand.

Thus, the replenishment recommendations are generated keeping all types of in-store promotions in mind, ensuring that the demand shifts and demand lifts across all promotions are factored in.

So, retailers can always order the high-demand items without risking out-of-stock as well as overstock of non-promoted items. This automatic inventory recalibration empowers retailers to keep their promotional revenue intact without risking stock imbalances.

Accurate demand forecasting via cutting-edge AI capabilities is no longer a nice-to-have, especially in rapidly evolving retail segments like health, beauty and wellness. It paves the way for optimal replenishment, operational excellence, reduced wastage and minimizes the vulnerability to markdowns and capital lock-ins. With infallible accuracy and extremely exhaustive planning capabilities, it is definitely the way forward for the entire segment.

in Sweden from 7 - 8 October 2025. Pre-book a meeting to connect with our

product experts.

in Sweden from 7 - 8 October 2025. Pre-book a meeting to connect with our

product experts.