With 95% of consumers planning to increase their spending, the trillion-dollar shiny and glamorous retail segment of health, beauty, and wellness is a ripe opportunity up for grabs. However, new geographic hotspots, diminishing boundaries between wellness and beauty, and rapidly evolving trends are setting the stage for adaptive and agile retail planning.

Is your replenishment strategy still relevant, or are you constantly pivoting to new challenges like promotions planning, trend-chasing, and hunch-based inventory?

With customers forming multiple tight-knit cliques of diverse purchase preferences across different retail segments, traditional historical-data-based replenishment no longer serves the purpose.

For retailers, it’s a unique time to pivot themselves and leverage intelligent process automation to strengthen their foothold in the industry with optimized assortments across all locations. Here is a strategic framework to achieve this.

Decoding the Customer Demand at the Granular Level

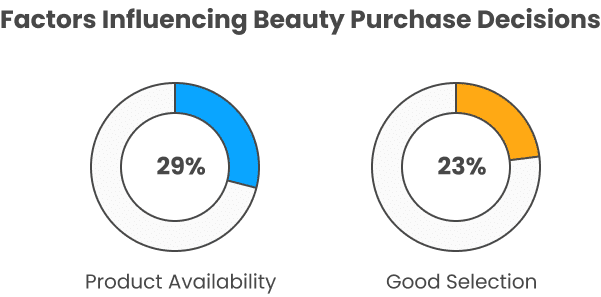

29% of beauty purchase decisions are motivated by product availability, and 23% of them are driven by a good selection of products.

Further, the beauty shoppers in the ages of 18-24 and 30-40 have highly nuanced preferences encompassing adaptogen-infused products, dermatologist-backed ingredients, and more. Thus, the regional-level demand planning and replenishment strategy becomes ineffective in health, beauty, and wellness retail.

The inability to anticipate customer demand well in time leaves retailers gasping for more stock of quick-moving items while ending up with piles of slow-moving items. The high unit costs and vulnerability to markdowns and obsolescence make it important to have a smart and agile replenishment framework that drills down to the SKU level and then generates replenishment plans.

AI-driven demand forecasting solutions can factor in thousands of constraints – sales influencers, historical demand, regional parameters, category & channel-specific factors, and much more – to generate highly precise forecasts.

Data-Driven Replenishment Instead of Hunch-Based Adjustments

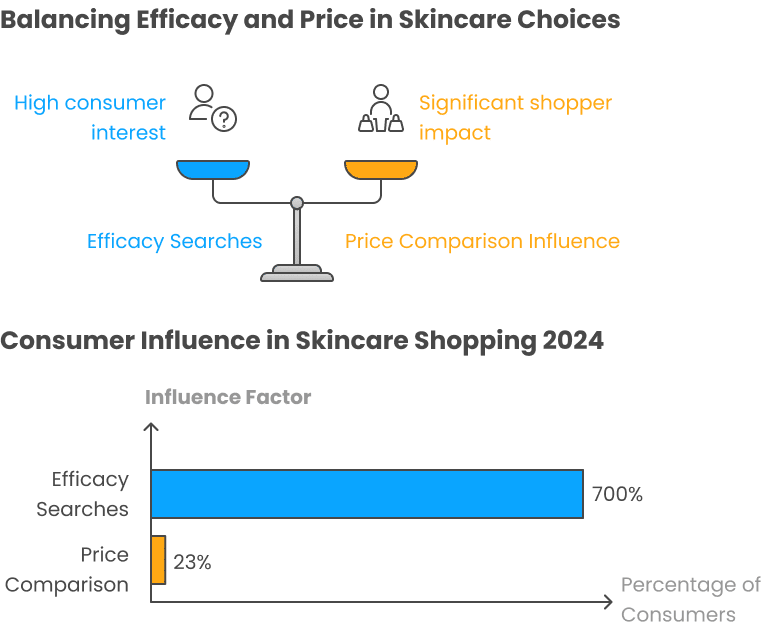

In 2024, skincare “efficacy” searches spiked by 700%, while 23% of shoppers were influenced by “product price comparison”.

While some customers are shopping across price points, some are enticed by the most-loved product in the influencer fraternity. Mere trend-chasing can easily spiral into overstock of slow-moving items and stockouts for quick movers. This means that demand planners need to mine and analyze a diverse and broader set of consumer, market, and purchase motivation data to optimize inventory.

AI-led replenishment planning solutions implement an analytics-driven approach for allocating inventory at all product locations. Retailers can choose from thousands of ensemble algorithms for each product-store combination and consider an unlimited number of customizable demand predictors.

This enables them to predict demand at a hyperlocal level and tune their replenishment plans based on a precise understanding of all constraints and demand influencers.

Bolster Brick & Mortar Value Props with Hyperlocal Demand Analysis

While online shopping has increased across health, beauty, and wellness retail segments, in-store buying and physical touchpoints still matter. As much as 40% of online retail includes a physical touchpoint.

According to the 2023 US Beauty Consumer Survey, as many as 54.2% of online beauty buyers say that trying on a new product during in-store shopping helps them discover new brands. Hence, having accurate inventory across all channels is critical for customer satisfaction, protecting revenue, and customer acquisition.

Inability to offer the right stock at the right location and right time can easily lead to customer churn, which is mostly irreversible, given the number of options available. This calls for replenishment planning with hyperlocal accuracy.

AI/ML-driven replenishment empowers retailers to offer highly tuned inventory as per granular demand patterns. Retailers can expand beyond core product categories and expand to adjacent categories or go deep in a specific category to gain spending share with customers.

Automating Promotions Management for “Every Offer”

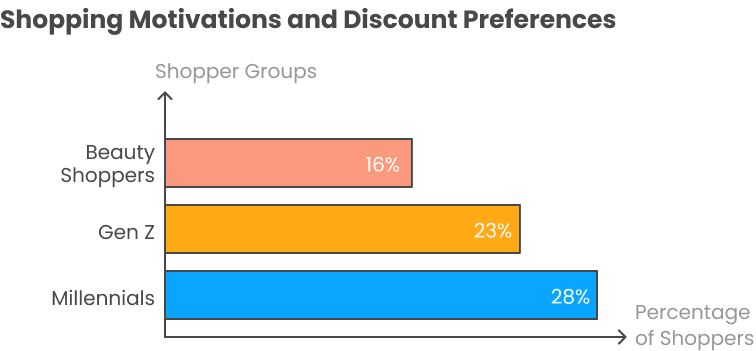

Promotions have a substantial impact on retailer revenues. Studies show that 16% of beauty shoppers’ pre-shop motivation comes from “Deals.” Also, 23% of Gen Z and 28% of Millennials only buy products on discount.

However, the promotions in health, beauty, and wellness retail are particularly complex. A diverse set of promotions is running in parallel, making it hard for retailers to identify and capture the promotion-induced demand shifts and lifts, leading to cannibalization.

The cannibalization effect can eat away as much as 17% of the promotional gains, thereby causing retailers double harm. Intelligent replenishment solutions offer dynamic demand balancing for demand shifts and lifts during promotions. Thus, retailers end up ordering more promoted items and fewer unpromoted items, effectively cutting both overstock and stockouts.

Master the Three A’s – Agility, Adaptability, and Assortment

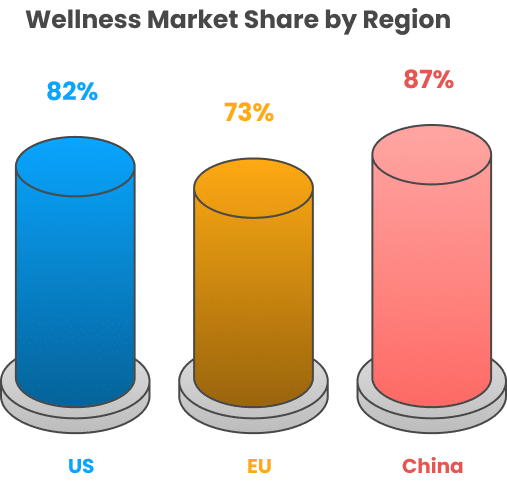

The beauty and wellness sectors are converging, with a combined value of $140.7 billion in the US alone. Wellness alone has a market share of 82% of consumers in the US, 73% in the EU, and 87% in China.

While consumer focus on wellness and efficacy-backed products is increasing, emerging disruptions will ultimately affect retailer revenues. Further, retailers need to invest in replenishment frameworks that are agile enough to recalibrate inventory while keeping pace with trends.

AI-led demand forecasting and replenishment solutions forecast demand at the product-location level and tune order plans for inter-SKU plays while adapting to supply-side deviations. They empower retailers with holistic inventory optimization across warehouses, stores, and distribution centers, thereby facilitating precise planning and replenishment.

While the market opportunity in health, beauty, and wellness retail is huge, rapidly evolving demand patterns and trend-induced purchases are ruling the scene. Sticking to the same old one-size-fits-all replenishment strategy can cause retailers to lose out on anticipated gains.

Retailers can no longer afford manually cranked inventory decisions based on static sales or demand data. AI-driven inventory allocation tuned to hyperlocal nuances to offer wider assortments, while adapting to real-time demand patterns and agile recalibrations to supply-side deviations, is the right way to go.

in Sweden from 7 - 8 October 2025. Pre-book a meeting to connect with our

product experts.

in Sweden from 7 - 8 October 2025. Pre-book a meeting to connect with our

product experts.