NRF APAC 2025, held June 3-5 in Singapore, didn’t just spotlight the latest in retail technology — it revealed a clear call to reset, reimagine, and realign. Across packed halls and intimate sessions, the takeaway was unmistakable: in a world that’s racing forward, relevance is no longer a nice-to-have. It’s oxygen.

What stood out wasn’t just what was being discussed, but how. Retail leaders, technologists, and brand stewards weren’t speaking in future-tense projections. They were unpacking real-time, lived challenges and articulating how strategy, data, and empathy must converge to build retail for the now.

Here are five signals that emerged with lasting implications for what comes next.

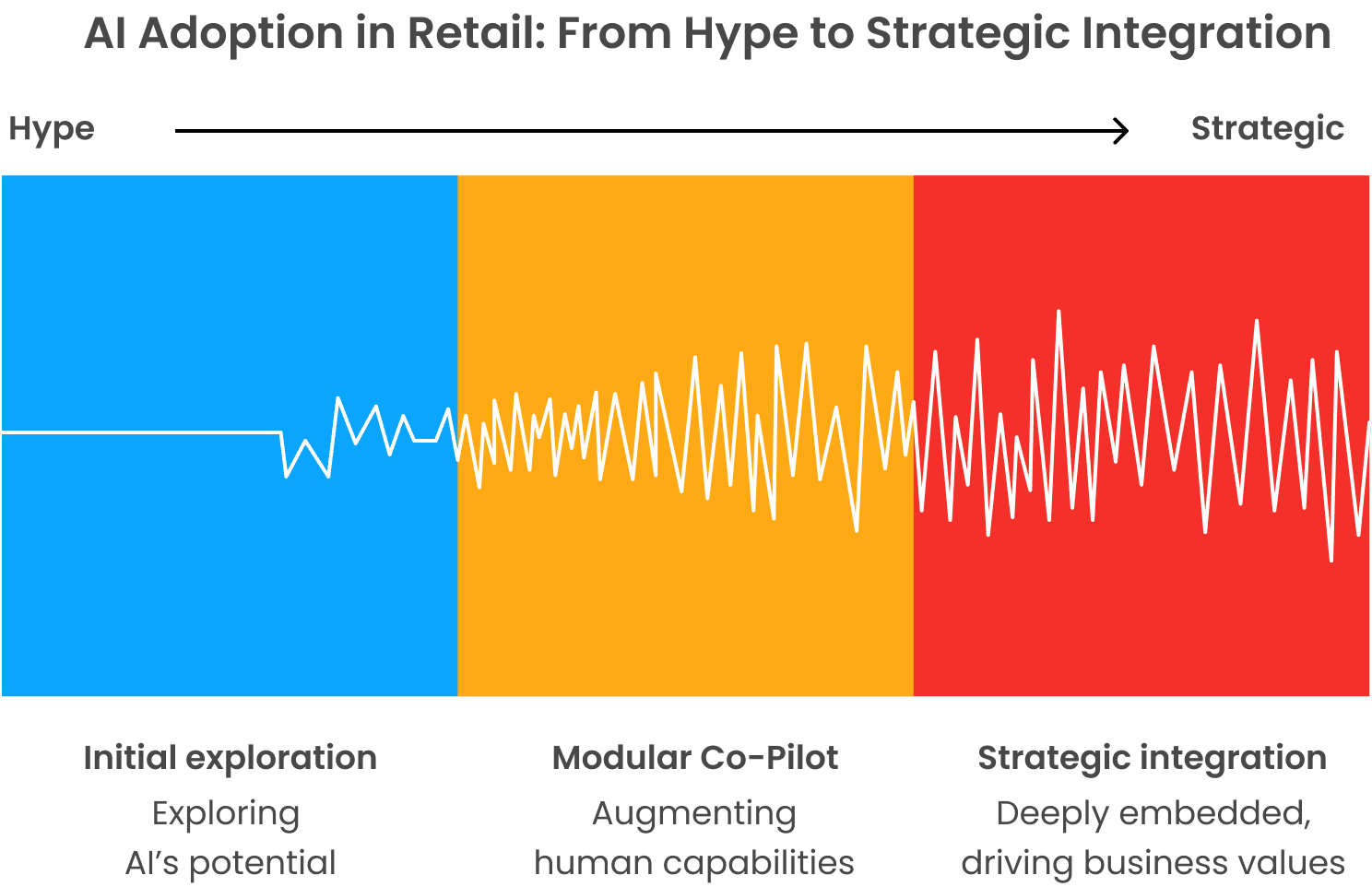

1. AI’s Maturity Moment Has Arrived

Retailers are past the hype curve. The question is no longer if AI should be used, but how deeply and to what end.

The conversations at NRF reflected a shift from experimentation to accountability. AI isn’t viewed as a monolithic solution anymore. It’s a modular co-pilot — one that augments human creativity, sharpens precision, and adapts to customers at speed.

Use cases are expanding: from weather-adjusted inventory planning and real-time demand forecasting, to AI-generated promotions, hyper-personalized search, and fraud detection.

However, a sobering theme surfaced: while many brands have the infrastructure, most still lack organizational clarity and cultural readiness to scale these tools with intention. Without a clearly defined “why,” AI risks becoming performative rather than transformative.

Retailers also face a build vs. buy dilemma. While enterprise brands may build proprietary AI stacks (as seen with Lenovo’s Computer Vision AI), SMBs and mid-sized players are seeking modular, plug-and-play solutions that let them experiment without heavy investments.

Our takeaway? Flexibility, scalability, and outcome orientation will define vendor partnerships in the next 24 months.

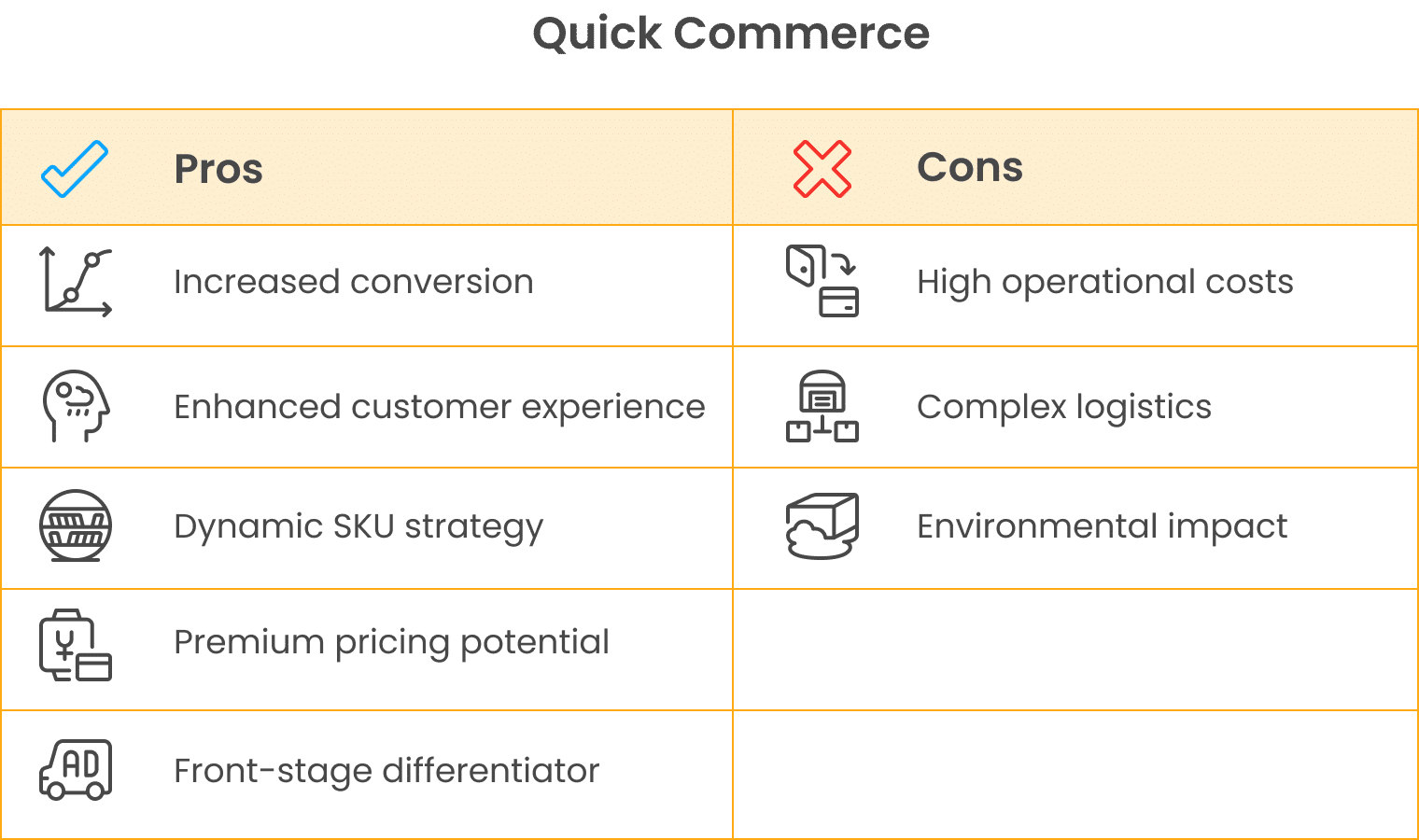

2. Quick Commerce Is Redefining the Experience Layer

Quick commerce has officially transcended grocery.

A/B tests at the event showcased how a delivery promise of 8 minutes (vs. 12) increased conversion rates by nearly 70%. That’s not just faster logistics; it’s a psychological unlock. Speed doesn’t just fulfill a need; it communicates respect, urgency, and recognition.

Grocers shared how they’re now linking demand forecasting with meteorological shifts (e.g., stocking firewood before a cold snap), regional events (like Pongal or Lunar New Year), and local festivities. The SKU strategy is becoming dynamic — less about static seasons and more about microbursts of real-time relevance.

Fashion isn’t far behind. In Tier 1 cities, consumers are already buying sneakers and accessories for same-day plans — and expecting 30-minute delivery as default.

According to a Bain study, 60% of APAC consumers are willing to pay a premium for faster delivery, especially in lifestyle and food categories — a crucial monetization lever for Q-commerce investments.1

This shift reframes quick commerce from a back-end function to a front-stage differentiator. The brands that win won’t just deliver quickly. They’ll deliver intuitively.

3. Gen Z Isn’t a Demographic — It’s a Design Philosophy

Retailers have long chased Gen Z. But NRF revealed something deeper: Gen Z is reshaping how retail thinks.

This generation scrolls fast, shops impulsively, and gravitates toward self-expression, not conformity. They discover via TikTok and creator drops, not category pages. And they’re allergic to friction, repetition, and brand posturing.

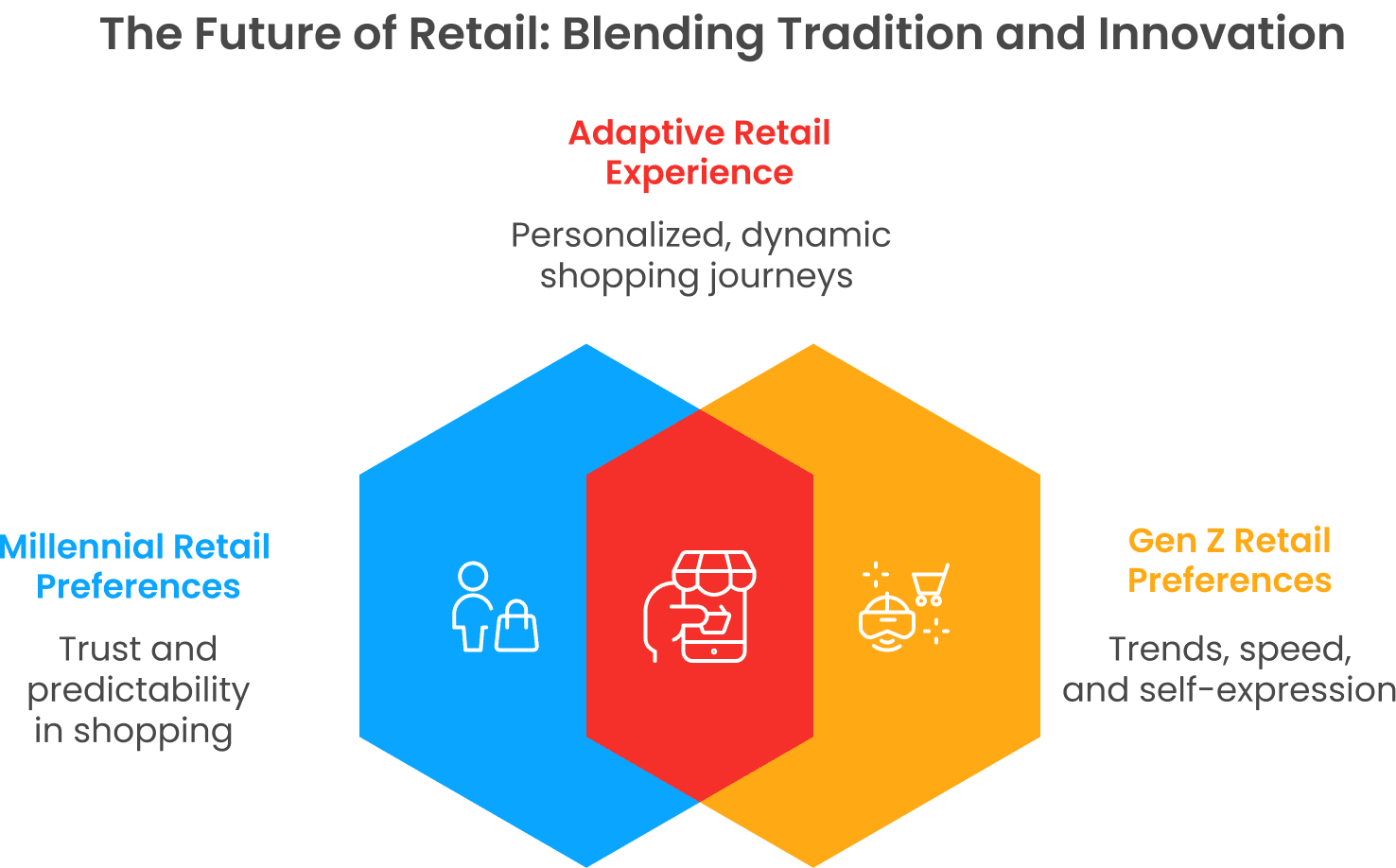

Retailers shared a powerful construct: the “Two Highway Model.” One lane serves brand-loyal millennials who seek product trust and predictability. The other caters to Gen Z’s hunger for trends, speed, and cultural cues. The key is not choosing one. It’s building both, with AI dynamically routing shoppers based on behavior, not age or assumptions.

Fast-fashion players like Myntra are already using AI to test, launch, and retire thousands of SKUs weekly, each tuned to microtrend signals from Gen Z feeds.2

For retailers, the opportunity is clear: don’t just localize the experience. Socialize it. Make discovery feel personal, participatory, and proud.

4. Relevance Is the New Loyalty

In an attention-fragmented, inflation-sensitive world, loyalty can’t be bought. It must be earned in the moment.

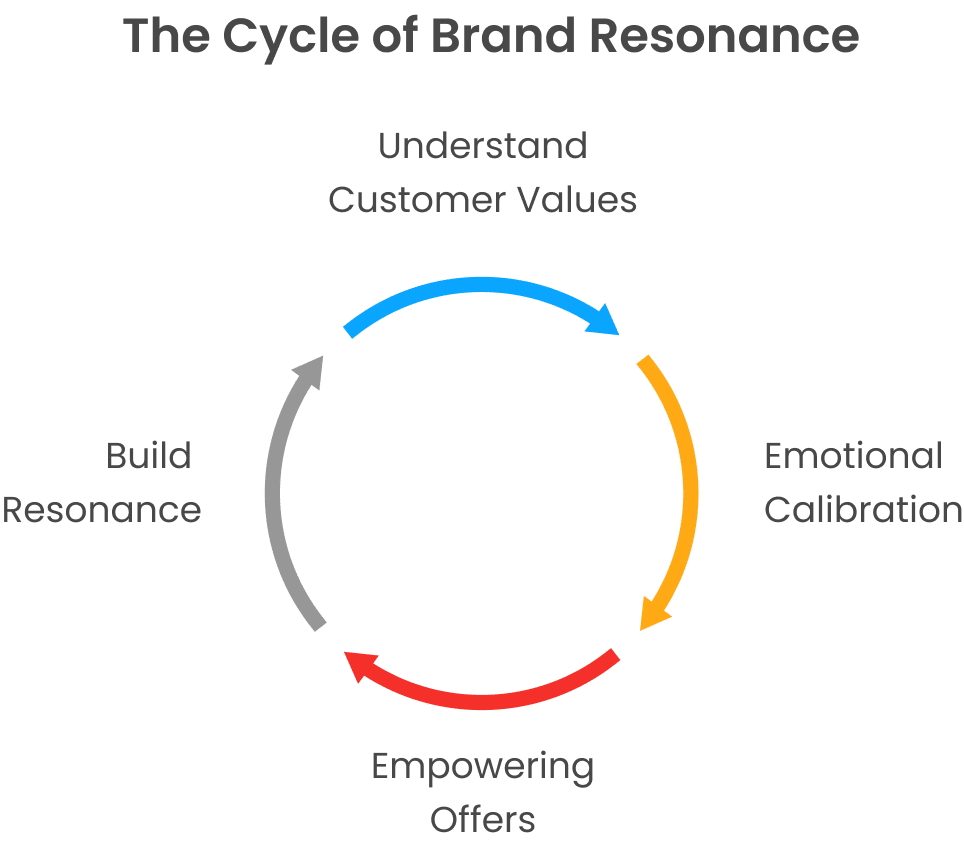

NRF conversations repeatedly emphasized the death of transactional loyalty. Points, push notifications, and basic personalization aren’t enough. Shoppers are gravitating toward brands that feel like them — that listen, adapt, and stay emotionally in tune.

What’s replacing loyalty is resonance.

This means AI needs to evolve from “If X, then Y” personalization to real-time emotional calibration. Algorithms should ask: Is this the right tone for this customer today? Is this offer empowering, not just tempting?

A McKinsey report finds that over 70% of Gen Z consumers say they’re more likely to engage with brands that reflect their values, even more than price or product range.3

5. The Middle of the Market Is the Next Frontier

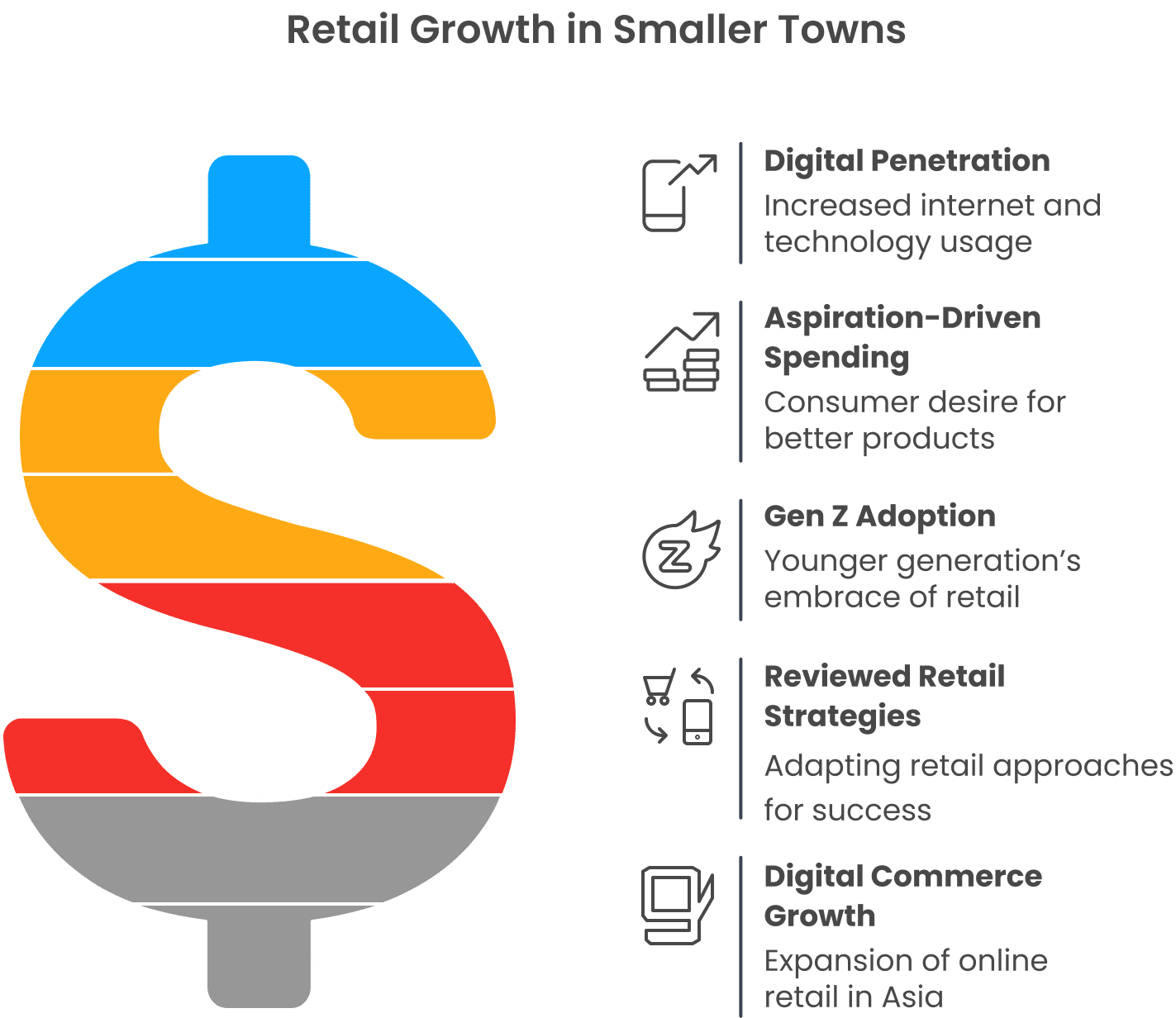

Smaller towns are seeing an upswell in digital penetration, aspiration-driven spending, and Gen Z adoption. Retailers who succeed here aren’t the ones who scale down their metro playbooks — they’re the ones who rewire them.

Deloitte APAC forecasts that non-metro retail markets will drive 65% of digital commerce growth in Asia by 2027.4

The Biggest Takeaway: Don’t Follow Trends. Catch Signals.

NRF APAC 2025 was a mirror of what the best in retail are doing right now to stay relevant.

The winners are not those who chase trends. They’re the ones who catch signals — from culture, customers, and commerce — and turn those into decisive action.

At Algonomy, we’re building for that kind of retail — where decisions are data-informed, but empathy-led. Where speed meets story. And where AI doesn’t replace humans, it empowers them to create relevance at scale.

If your brand is ready to turn signals into outcomes, let’s talk! hello@algonomy.com

in Sweden from 7 - 8 October 2025. Pre-book a meeting to connect with our

product experts.

in Sweden from 7 - 8 October 2025. Pre-book a meeting to connect with our

product experts.